GROUPS & LEDGERS

GROUPS: - Groups are collection of ledger of

the same nature. Tally provides lists of 28 pre-defined groups of these 15 are

primary group & 13 are groups 9 primary groups appear in the balance sheet

they are capital in nature. 6 primary groups appear in the profit & loss

account.

1. CAPITAL A/C:- Partner’s capital A/c or

Proprietor’s A/c should be opened in this group. This group has sub group reserve &

surplus.

·

RESERVE & SURPLUS: - This group can accommodate ledger

for reserve generated such as investment allowance & surplus from earning

after disbursement of dividends etc.

2. CURRENT ASSETS: - This primary group and covers all

the assets which are grouped under six groups.

·

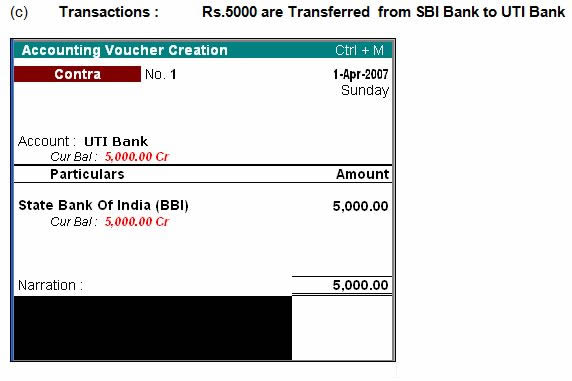

BANK ACCOUNT:-This subgroup covers all the Bank Accounts current & saving A/c etc. in all the banks being maintained by the

company. The bank in which our current & savings A/c is there is opened

under this group.

·

CASH IN HAND: - Cash A/c is opened in under this

group it is already provided it is a pre-defined group.

·

DEPOSITS (ASSETS):- These subgroups are for deposits. Made by company for e.g. fixed deposits, saving deposits.

·

LOAN & ADVANCE ASSETS: - These subgroups are for the ledger on

all types of loans & advances given by company for e.g. advances for

purchase.

·

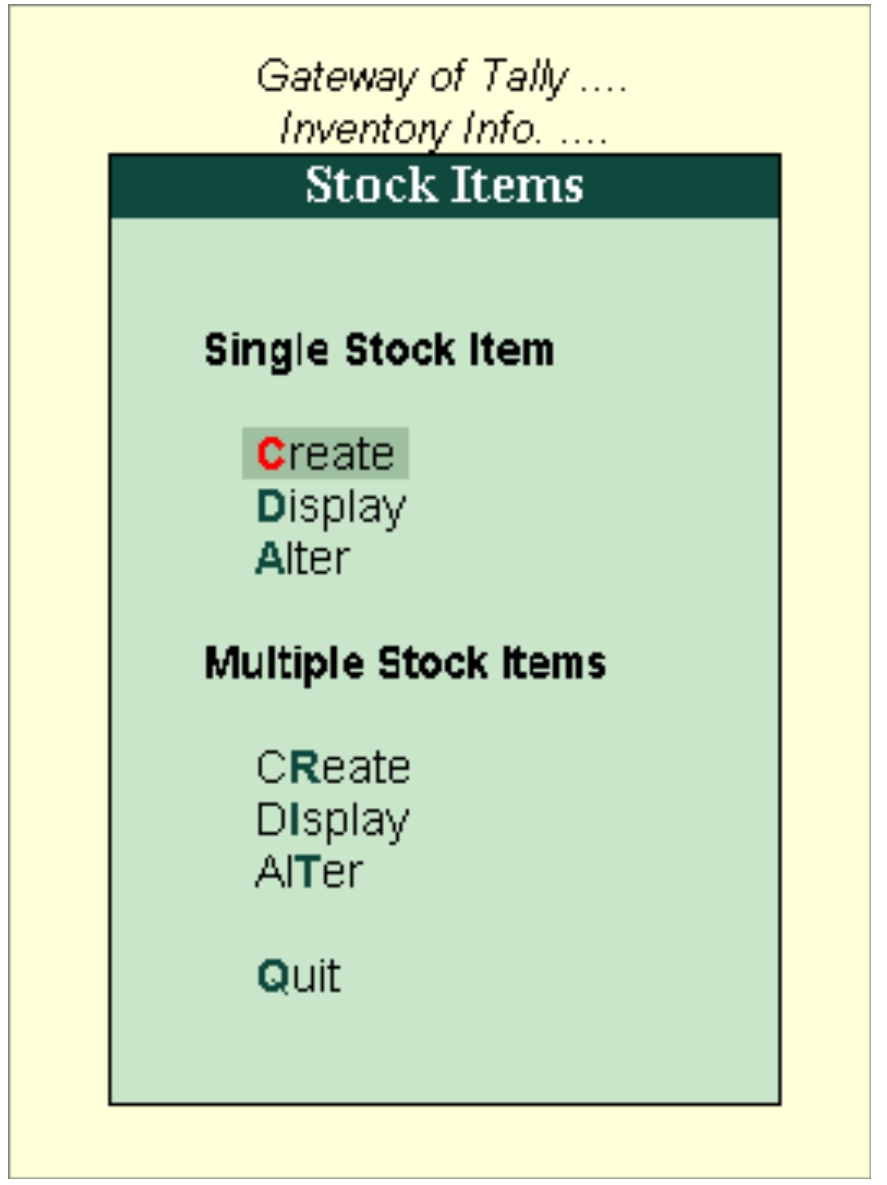

STOCK IN HAND: - These subgroups are to keep records

of opening & closing stock for accounting purposes. This data is for

internal accounting and no transaction takes place.

·

SUNDRY DEBTORS :- These subgroups are for keeping the A/c’s of companies & parties to whom company sold goods on credit thus for

sundry debtor.

3.CURRENT LIABILITIES: - This is a primary group in which the liabilities of the company including statutory liabilities are maintained for

e.g. funds Tax deducted at source (TDS), outstanding payment.

·

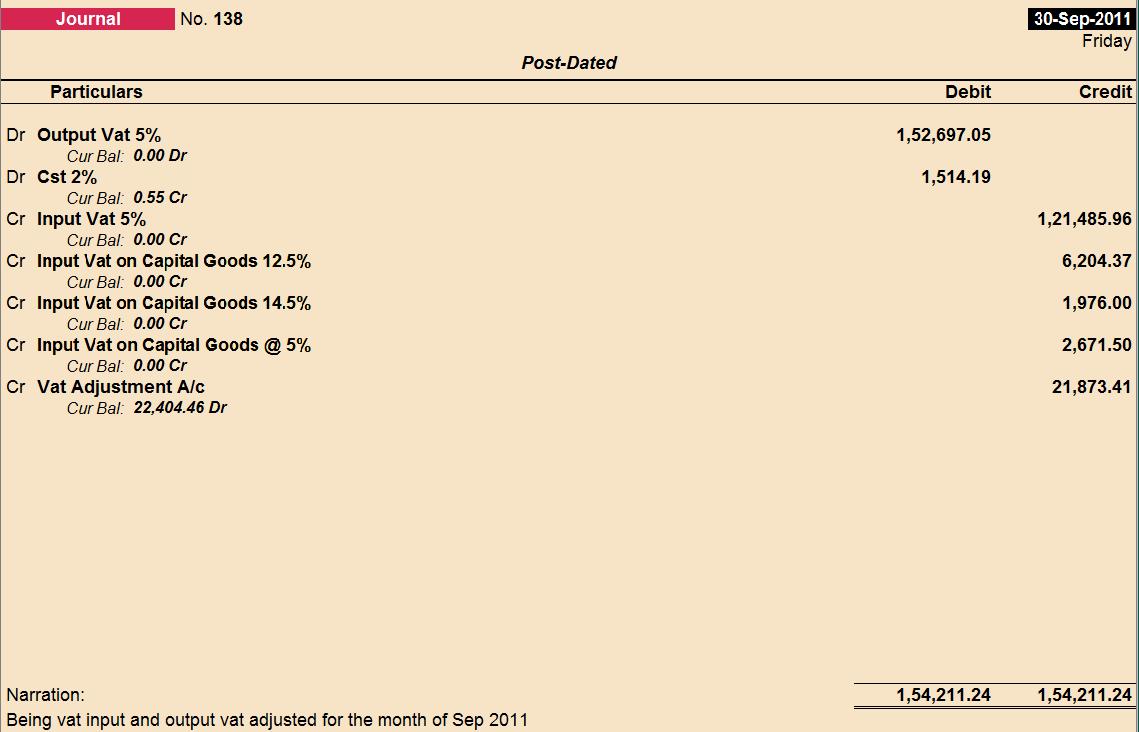

DUTIES & TAXES: - All the duties & taxes like

excise duty, sales tax both central & state maintained under this head.

· PROVISIONS: - These subgroups are for keeping track

of various statutory & non-statutory provisions like income tax, provident

fund etc.

·

SUNDRY CREDITORS: - These subgroups are for keeping the

A/c of creditors of the company from whom goods are purchased on credit. Thus

to group sundry creditors.

4. FIXED ASSETS: - This is a primary group to keep

track of all the fixed assets of the company, such as value of machinery, building & furniture.

5. INVESTMENTS: - investment made by company for e.g. investment made in govt. bonds, share,

debentures.

6. LOAN (liabilities):- This is a primary group and as the

name suggests it is meant to keep ledger on all loans taken by the company and

has three subgroup as below.

·

BANK O/D A/C (BANK OCC A/C):- The bank ledger from which loan is

being taken by this company is opened under this group.

·

SECURED LOANS: - This subgroup is mean to keep track

of the loans taken by the company securities institution or banks for e.g.

debentures A/c.

·

UNSECURED LOANS: - These subgroups are mean to keep unsecured loans taken by the company, from any party or person including

directors and partners or a bank for e.g. Bank O/D.

7. SUSPENSE A/C:- This is a primary group

to keep suspense

account and is mean to keep track of money paid or received by the company for which the details of transaction are yet to finalize.

Most of advances fall into this category like

advance given for miscellaneous expenditure or travels advances for which

details will be available after the purchase bill.